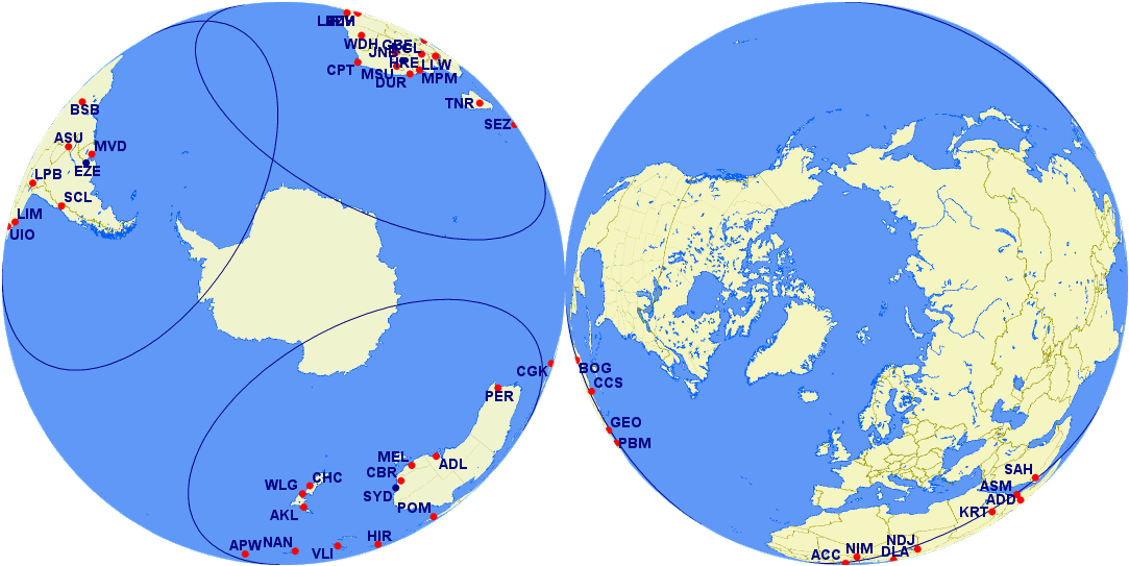

A Tale of Three Capes

Three geographically remote airlines have vastly different performance & prospects

Air transport and seafaring have much in common. Both carry passengers and cargo to their destinations on scheduled services. Both operate in hazardous environments so are prone to operational disruption. Both try to ensure that their vessels, be they air- or ocean-craft, take the shortest and most efficient routes possible. And private jet interiors of…

Keep reading with a 7-day free trial

Subscribe to Airline Revenue Economics to keep reading this post and get 7 days of free access to the full post archives.