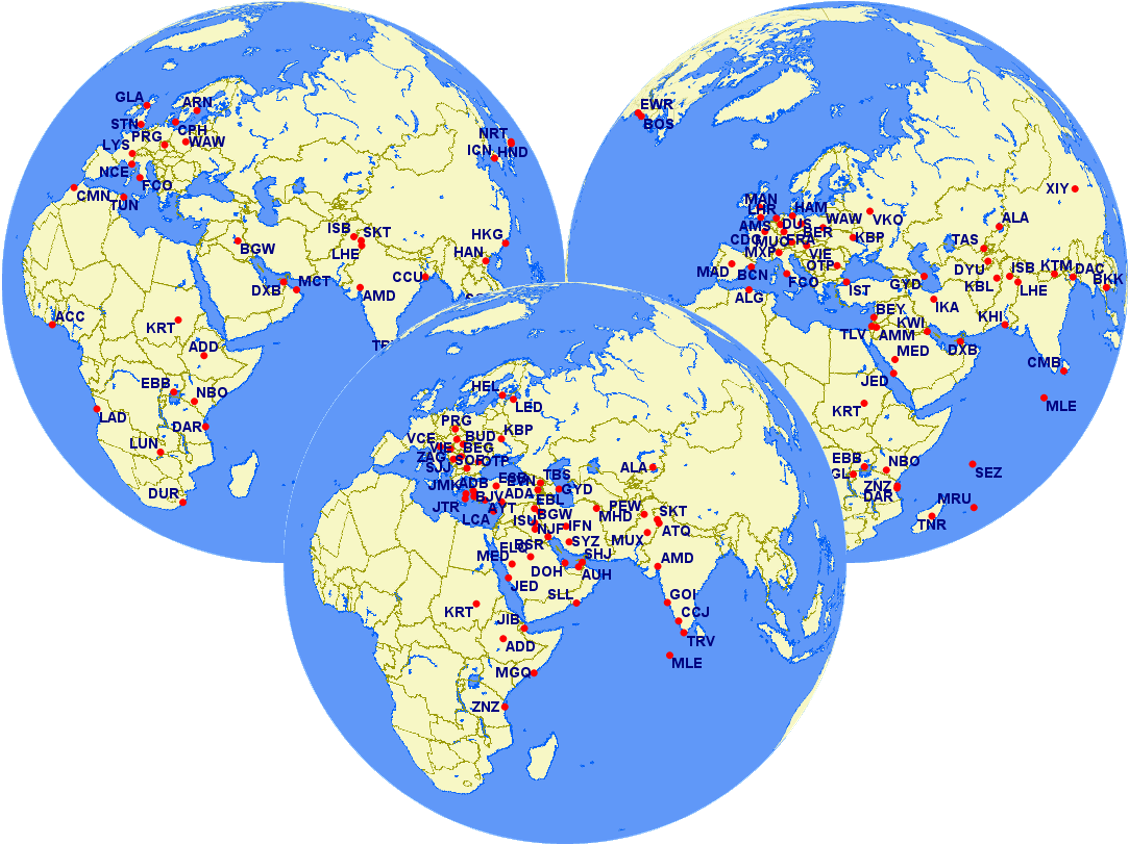

Turkish Airlines offered what was arguably the smartest airline promotion ever. Fly via Istanbul today and flights connect seamlessly. But back around 2010 they did not have quite enough planes and many passengers had six, eight or ten hour connections.

Growing pains like these are a common experience across many carriers. But the clever people at Turkis…

Keep reading with a 7-day free trial

Subscribe to Airline Revenue Economics to keep reading this post and get 7 days of free access to the full post archives.