How do Qantas & Jetstar avoid competing with each other?

The low-cost carrier model is flipped on it’s head down-under

G’day! That’s how they say hello in Australia. The down-under greeting is brisk, friendly and pleasing to those who care for brevity.

A short form of “good day”, it makes you wonder what the Aussies do with all those extra “O”s that they have saved up. Perhaps they use them all to make remarkable place names like Woolloomooloo in New South Wales, a suburb of Sydney. Or snappy words like Bonza, now an up-and-coming airline.

Antipodean aviation is characterised by long stage lengths and innovation. Flights are long because cities on the south-east coast of Australia are a long way from both Asia and America.

The gruelling trips have fostered an innovation culture to make journeys more comfortable. Air New Zealand’s Sky Couch and Skynest bunk beds are good examples.

Everything is paid for by burgeoning economic growth and mass affluent prosperity. With a per capita GDP of nearly USD 50k (see article), many Australians can afford premium cabin travel and most would not need to worry about paying for an extra bag or an on-board coffee, supporting Qantas’ ancillary revenues (which reached the giddy heights of USD 59 per passenger more than ten years ago).

Australian carriers especially have to cope with a reasonable amount of competition. To some extent, sheer distance has kept European and American carriers away.

But middle eastern carriers like Emirates and Qatar Airways (see article) and asian giants like Singapore Airlines (see article) and China Southern threaten the local incumbents. Flag carrier Qantas recently lobbied the government for Qatar Airways to be refused additional flying rights.

Locally, Virgin Australia and a selection of Pacific carriers keep Qantas on their toes, although not to the same extent as large low-cost carriers (LCC) like Ryanair in Europe or Frontier in the United States do. When I did a short project with Air Vanuatu back in 2019, their head of revenue management described Qantas’ market power as “total”.

But competition in Australia may not be all that is seems. Qantas operates two brands – it’s mainline services with the famous kangaroo on the fabulous red tail and Jetstar, whose tail features a jazzy orange star contrasting nicely with dark grey text.

Jetstar is supposedly an LCC subsidiary. But unlike LCCs elsewhere in the world who tend to operate high frequency shorthaul services, Jetstar offers a large number of longhaul and low frequency flights. Many of their flights are to Qantas’s own mainline destinations.

Qantas are considered a financially savvy airline, with profits of $2.47bn in the 2022-23 financial year. There are on-going concerns about their quality of service and the extent to which they may or may not engage in dubious practices like selling tickets for flights that are not planned to operate. But we can be sure that outgoing CEO Alan Joyce would not have allowed Jetstar to compete with Qantas.

Instead, the two brands are likely to complement and support each other. I wanted to find out exactly how they make this happen. Read on to find out what I discovered…

Understanding Jetstar’s network

Jetstar operates 364 international flights a week to and from Australia, based on the Jun-2024 schedule. I have classed the destinations into four categories:

1. Kiwi – services to & from New Zealand

2. Antipodean islands – Denpasar, Fiji and the Cook Islands

3. Long-range cities – major international centres like Tokyo & Singapore

3. Long-range islands – Phuket in Thailand and the USA’s Honolulu

The number of Jetstar flights on each route type is summarised in the table below.

The idea is that ‘island’ destinations attract mainly tourists and the Kiwi and ‘city’ services attract the full range of business and leisure travel that you might expect for such destinations.

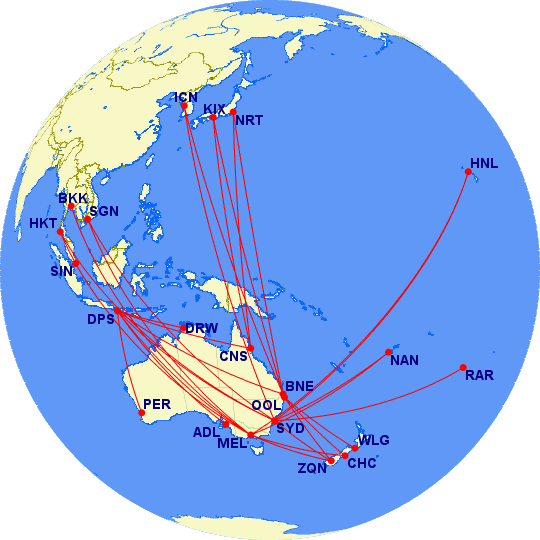

The map below shows Jetstar’s whole network. Notice that ten out of the 14 cities served have flights from more than one Australian city. Party central Bali Denpasar (DPS) has Jetstar services from seven Australian cities and is probably Jetstar’s most important and popular international destination.

[I generated all the maps in this article using the amazing Great Circle Mapper. You can too -try it out! (see article)

So what about competition?

To understand how Jetstar and Qantas avoid competing with each other on their international networks, I wanted to answer six questions.

The first three are about Jetstar’s wider network:

1. How do Qantas and Jetstar share routes in common?

2. On which routes does Jetstar operate to a Qantas destination, but from a different Australian origin city to Qantas?

3. Which destinations are Jetstar exclusives?

The next three are specifically about routes operated by both Qantas and Jetstar:

4. Do Qantas and Jetstar differentiate by aircraft type?

5. Do they leave on different days of the week?

6. Do they leave at different times of the day?

The quick answers are summarised in the table below.

But how did I get to those? Read on to find out …

The rest of this post is exclusively for my paid subscribers. If that is you, thank you and please keep reading. If you have not signed up yet, please do so today and think of it as buying me a beer to say thanks for writing these articles for you. I can provide a receipt on request if that helps you reclaim your subscription from your employer. The price will go up in November but you can lock in to the lower rate now!

Keep reading with a 7-day free trial

Subscribe to Airline Revenue Economics to keep reading this post and get 7 days of free access to the full post archives.