Saudi Arabia's Hidden Airport Champion

Cluster2 Airports is set for growth, but will not take the Kingdom far to meeting it's ambitious aviation goals

The Kingdom of Saudi Arabia (KSA) reckons it can triple it’s annual passenger volume by 2030 to become an aviation super-hub.

That would increase the number of people travelling to from or through KSA airports to 330 million, around six to eight per cent of global air demand. Or so said Minister of Transport and Logistics Saleh bin Nasser Al Jasser, and national aviation regulator GACA.

Their 2022 report, “Introducing the Saudi Aviation Strategy", is a fascinating read and a study in optimism. Since it is now 2025 we should now be able to tell whether or not they are on track to achieve their goals.

Every one of the hundreds of millions of travellers forecast, if achieved, will pass through one of the Kingdom’s 29 commercial airports.

We all know the mega hubs at Jeddah, Riyadh and Damman. Another ten airports serve petro-giant Aramco. Three more commercial airports are under construction.

Of the rest, 22 are operated by a company which few have heard of but which could be about to become important, called Cluster2 Airports. Call them KSA’s hidden airport champion.

GACA believes that only 10% of KSA’s 2030 ambitious air travel demand target will be made of transit passengers. The rest, a 200 million-ish increase on today’s volumes, will originate or terminate in KSA. This is supposedly a consequence of a Saudi dream that an emerging middle class will stimulate demand for air travel just as in Europe, the United States, some parts of Asia and Australia.

With 22 out of 29 commercial airports, surely many of these journeys will need to involve Cluster2. So can Cluster2 help the Kingdom achieve it’s aviation goals? Does the capacity and the demand even exist? Sadly I think it is unlikely that Cluster2 will generate as much demand as KSA’s rulers might hope. Read on to find out why…

This article was written with data from OAG Schedules Analyser: visit oag.com. Thanks OAG!

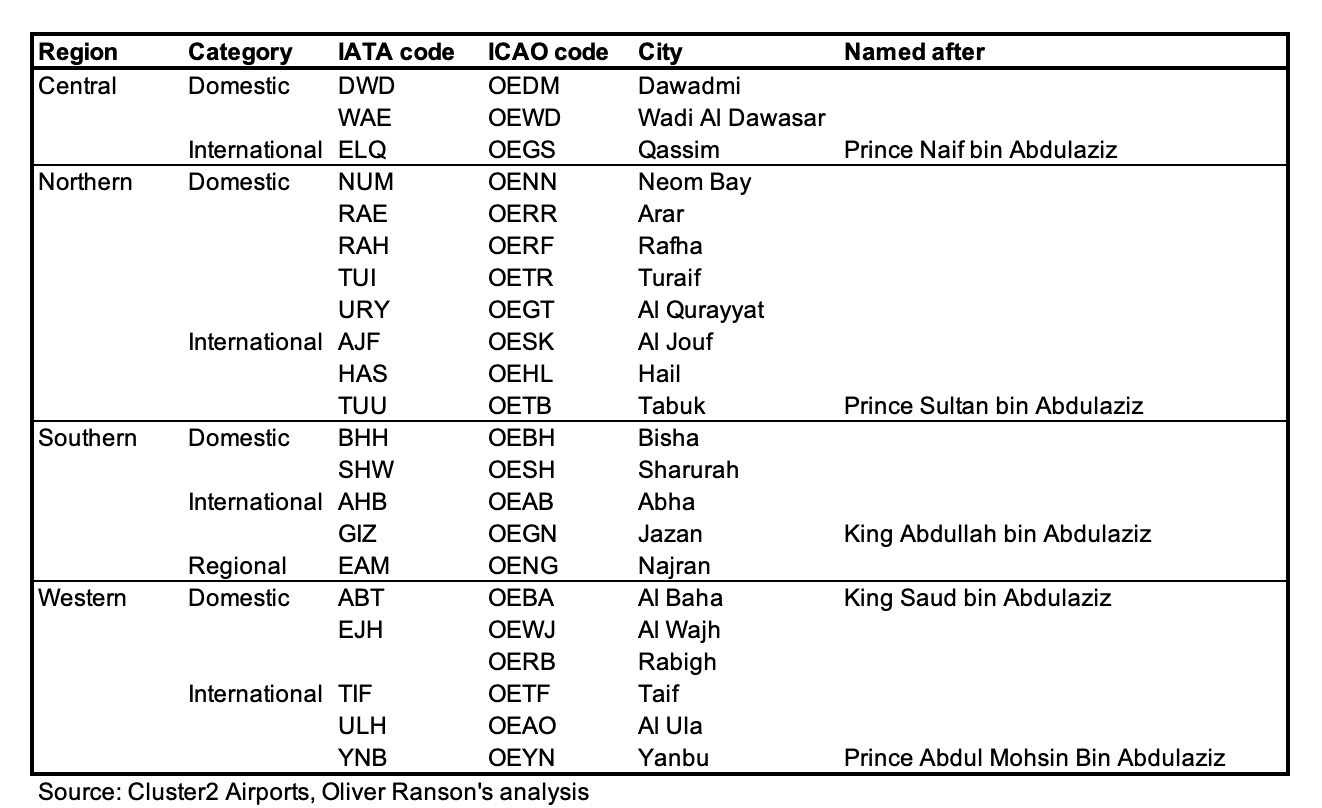

Cluster2’s airport portfolio is broad and includes all of KSA’s “other” airports

I have summarised Cluster2’s portfolio in the table and map below, with some other major airports shown for reference. As far as I can tell from my maps app, they all currently have one runway. For comparison, Dammam and Riyadh have two and Jeddah has three.

Map generated by the Great Circle Mapper: visit gcmap.com

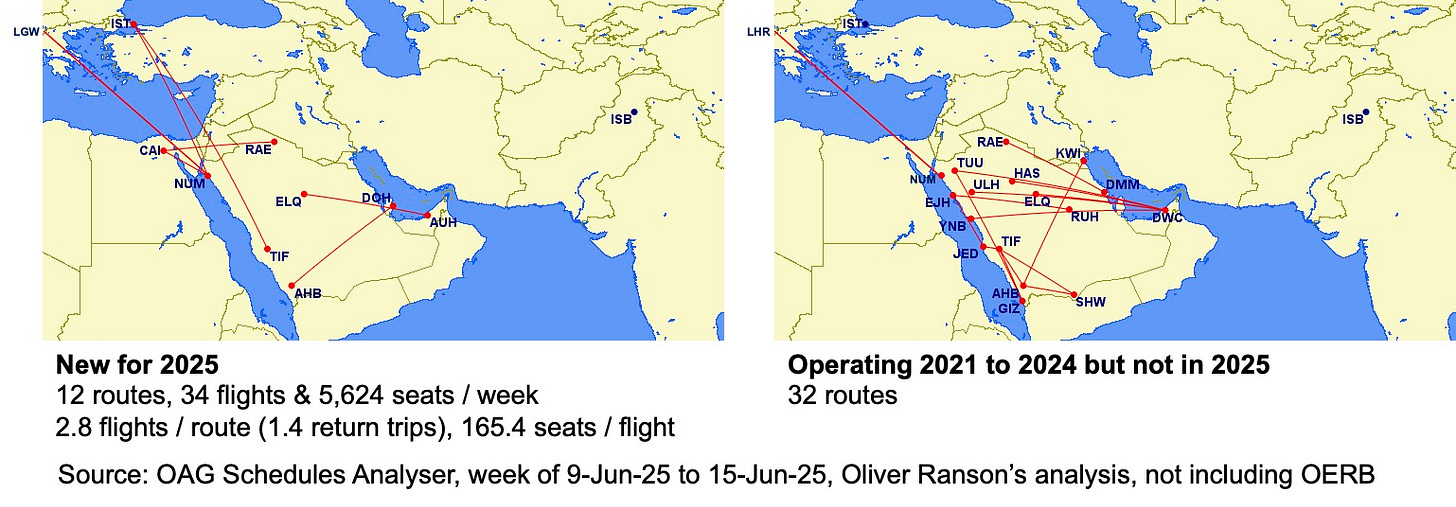

I used data for the second week in June, starting Monday, and collected all flights to and from Cluster2’s airports in that week of the years 2021 to 25.

If KSA is following it’s aviation strategy, these airports should be growing fast. So I wanted to collect flights for this year that are quite close to now. This means that if airlines really do perceive growing demand, they will have had a chance to schedule flights.

The second week in June is not in the Ramadan month in any of my years. A few days are towards the end of Eid ul Adha, an Islamic holiday, in 2025. Because it is at the end of the holiday flights should not be atypical.

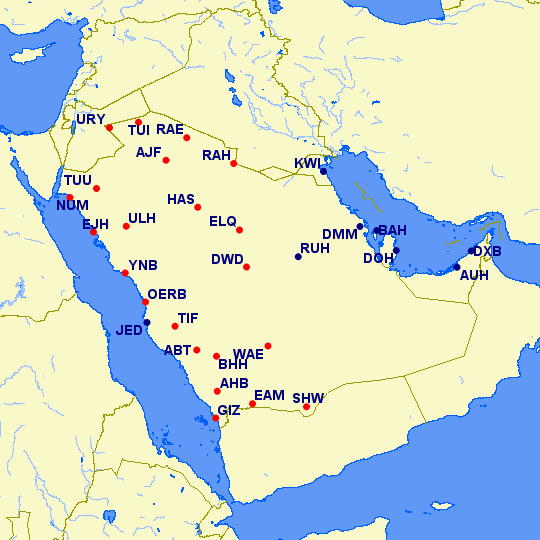

Cluster2 divide their airports into four regions. GACA classify airports as either international, domestic or regional.

The maps below show how in the Central region, Qassim Airport (pictured above) has plenty of international services. Back when I was at Qatar Airways we started flying to Qassim despite their being not much demand.

Apparently it is where all the Saudi royal family come from. It is interesting to see that there are no flights from Qassim to anywhere in Saudi Arabia apart from Jeddah, Riyadh and Dammam. Perhaps those royals who run the country all fly private anyway and those who don’t prefer Cairo, Bahrain and Dubai.

Cluster2 is currently a single-aisle set of markets, with a consistent 165 to 170 seats per flight. Only four flights a week are operated by a twin-aisle, a Saudia 777 with 381 seats on Riyadh to Ula and back.

Cluster2’s routes appear to be characterised by a low degree of frequency during this period of growth, with the average route served less than daily in three regions, which is not ideal for consumer choice and yield.

Cluster2’s growth is OK but will not take KSA far to it’s 330 million passenger goal

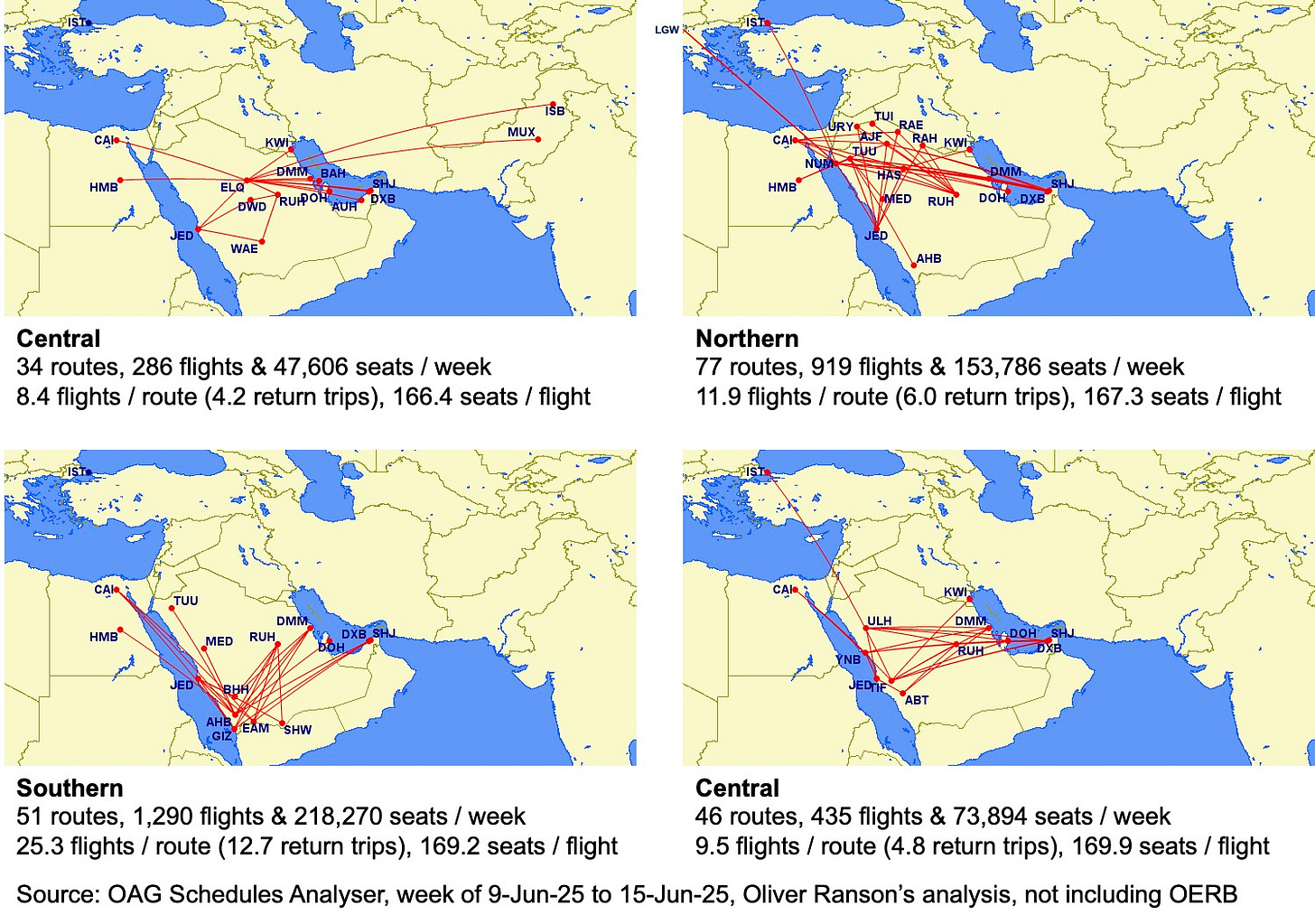

Cluster2 does seem to be growing it’s route network, albeit not without issues. The map below shows that 12 routes and 34 flights providing 5,624 seats have been added in 2025. 32 routes operating between 2021 and 2024 are no longer served.

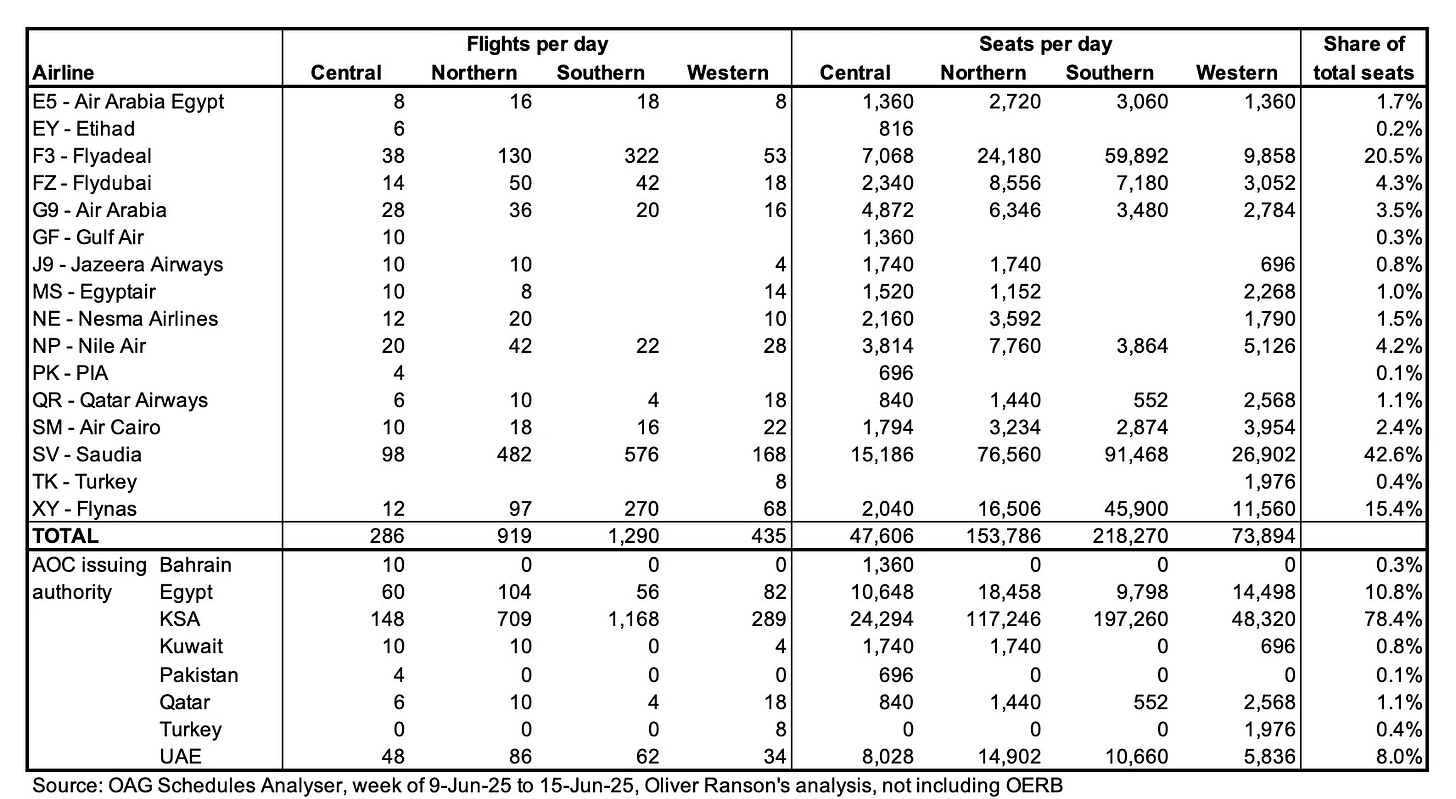

The table below shows the number of flights and seats operated by each of Cluster2’s airlines in our data week. It also aggregates the totals to show how reliant Cluster2 is on airlines from different countries.

Incumbent flag carrier Saudia is Cluster2’s top customer, with 42.6% of daily capacity. Saudia is the operator flying direct to London Gatwick from Neom Bay. Other KSA carriers Flyadeal and Flynas follow. There are five Egyptian carriers and three UAE airlines.

The table shows that nearly 80% of Cluster2’s capacity comes from KSA’s airlines. 10.8% comes from Egypt and 8.0% from UAE. Either Cluster2 is struggling to attract overseas airlines. Or the Saudi dream is not working and the KSA airlines are flying into Cluster2 at a loss as a form of public service, subsidised by the government.

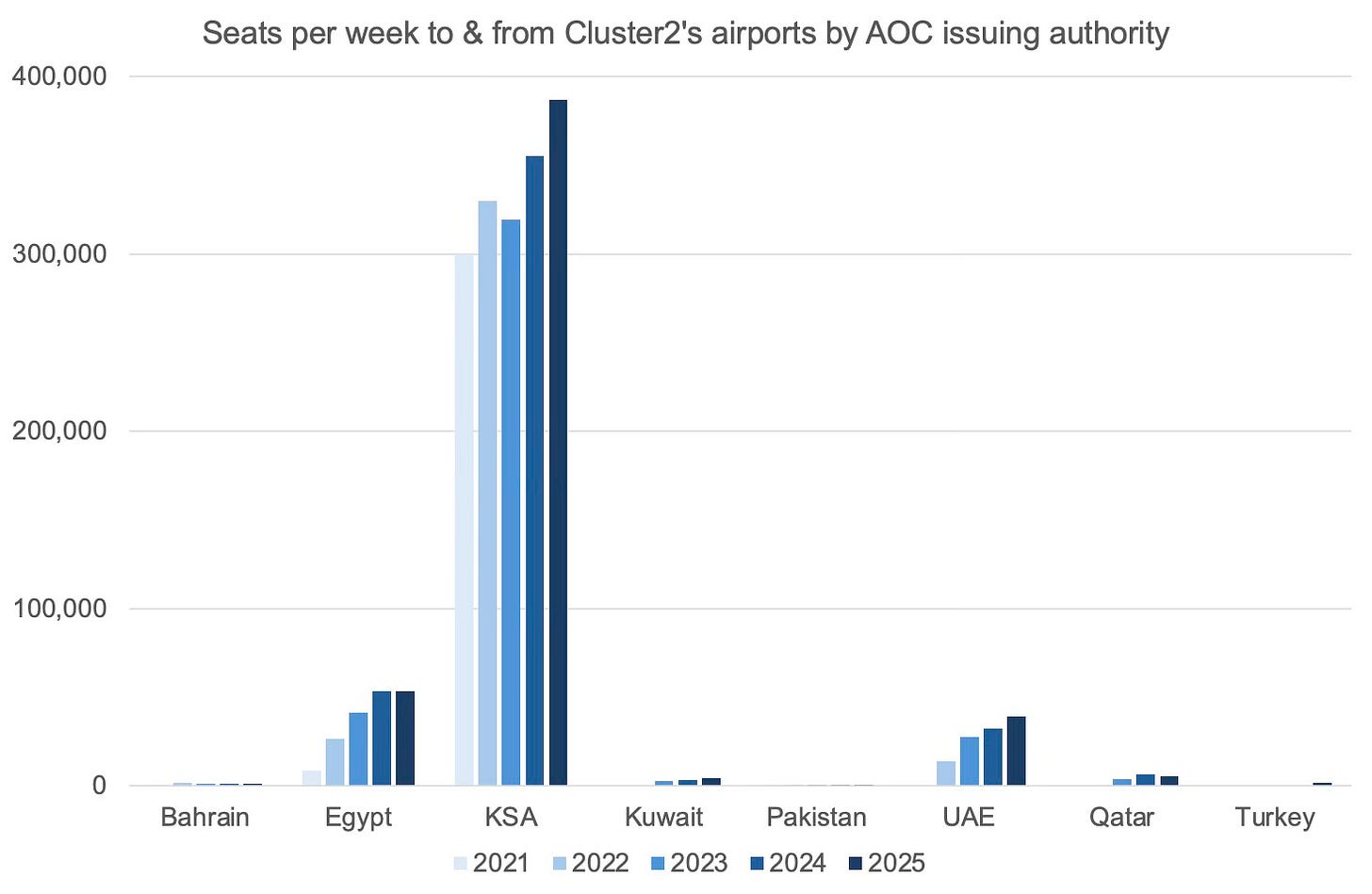

The chart below shows how airlines from KSA and overseas markets are growing capacity to and from Cluster2’s airports between 2021 and today.

What might this chart look like in 2030. There will be four potential sources of capacity growth.

1. Market entry of Riyadh Air, who have 60 single-aisle A321neos on order ripe for deployment to and from Cluster2 airports, and expansion of other KSA carriers

2. Expansion of Egyptian carriers

3. Expansion of UAE-based carriers

4. Expansion or market entry of carriers from other countries.

KSA carriers have increased their capacity to and from Cluster2 at an average rate of 6.7% per year between 2021 and 2025. If we assume that this rate of growth continues, supported by market entry of Riyadh Air, Cluster2 seats operated by KSA airlines would increase by 155,059 per week to 542,179.

It looks like Egyptian market entry has stalled as there were 53,402 seats from carriers based in Egypt in 2025, down slightly from 53,471 in 2024. Egypt is a prominent destination for Saudia, who operated 49 flights a week from Jeddah to Cairo and 14 from Riyadh when I last looked at them (see article).

Egypt is a middle income economy, with current GDP per capita at $3,174 (£2,354) in nominal terms and $21,668 (£16,058) adjusted for purchasing power. Growth at 3.8% is moderate, although since population growth is only around 1.4% per capita incomes should be growing.

Since GDP per capita is highly correlated with demand for air travel (see article), it is plausible that demand into Saudi Arabia may grow, but not to a great extent. If Egyptian carriers increased capacity by 2.5% per year, they would be operating 68,569 seats a week into Cluster2 by 2030, an increase of 15,167 seats a week against current.

Unlike Egypt, the UAE is a high GDP per capita country. It’s GDP per capita is currently $51,290 (£38,035) in nominal terms and $82,000 (£60,809) adjusted for purchasing power. It is also holds Dubai, the middle east’s most popular tourist and weekend break-style destinations. If the Saudi dream works out, many of the newly minted middle class travellers will want to travel to UAE.

Accordingly it is plausible that UAE carriers may expand capacity to the second tier KSA cities where Cluster2 operates. In the last two years, UAE capacity to Cluster2 airports has increased by 19.4% on average. If this rate of expansion were to continue to 2030, UAE carriers would be operating 103,783 seats per week to Cluster2 airports, a large increase of 64,356 seats a week against this year.

When it comes to carriers based in other countries. Bahrain is small, as is Kuwait. Pakistan is low income. Qatar and KSA dislike each other and KSA participated in the blockade of Qatar. Turkish carriers could be a source of capacity, if demand exists. Let’s assume a 10% increase in capacity by airlines based in these countries.

So we have a forecast for 2030 of:

1. 542,179 seats a week from KSA carriers

2. 103,783 seats a week from UAE carriers

3. 68,569 seats a week from Egyptian carriers

4. 14,969 seats a week from airlines based in other countries.

Total: 729,500 in 2030 vs 493,556 today. Annualising these numbers gives 38.1 million seats a year against 25.7 million today. That increase of 12.4 million is impressive but only 5.6% of KSA’s growth target even if all the extra seats are sold.

Assume an 85% seat factor and we get 32.4 million passengers by 2030, an increase of 10.5 million against today. But are those seats actually being sold in any quantity that a fully commercial airline would consider reasonable? Only Saudia and the other KSA airlines really know for sure.

Cluster2’s addressable markets are unlikely to be driving air travel growth in the near future

Looking at the economics of each of the cities and regions served by Cluster2’s airports, it seems unlikely that a prosperous middle class will be emerging to cause a boom in air travel demand any time soon.

I have written before about how thriving air travel markets require both push and pull factors (see article). Push factors are a thriving jobs base supporting middle class employment that creates demand for business travel pays people the sort of salaries they need to take their family on holidays. Pull factors attract people to a region.

Most of Cluster2’s markets have agriculture as a primary industry. Agriculture creates some wealth but it tends to be concentrated in the hands of a few individuals. Accordingly agriculture heavy regions have a small push factor and no pull factors.

As well as being the home of KSA’s royal family, Qassim is particularly famous for it’s food production and is known as the “city of dates”. Taif is known locally as the “city of roses” and also produces citrus, grapes, berries and figs.

Tabuk and Abha are similar, producing fruit and grains, and honey respectively. Al Jouf has abundant groundwater, supporting a sizeable olive industry. All these places seem likely to offer traditional labour demand. They are unlikely to see a boom in air travel demand from agriculture any time soon.

Bisha is somewhat more industrial. As the location of King Fahd Dam it contributes a great deal to KSA’s water infrastructure, but not necessarily much to a burgeoning middle class with discretionary willingness to pay for international travel. Bisha’s population is only 200,000 people. It’s three million palm trees supply fruit but do not require airline tickets.

Yanbu however is a genuine industrial hub. It is the second-largest Red Sea port and serves as the major break of bulk point for Medina. Yanbu also has three oil refineries and a plastics industrial factors. Arar is also a transport hub, the gateway to Iraq, Jordan and Syria.

It is likely that these industries in Yanbu will support the type of services sector that employs a prosperous middle class keen to buy plane tickets. Yanbu is also a scuba diving centre, attracting plenty of tourists. That gives Yanbu both significant push and pull factors that will create demand for travel through Cluster2’s airport.

Other tourist centres include Abha, which hosts the Asir Summer Festival featuring traditional dances, music, camel races and local arts and crafts. Hail’s annual car rally may also attract inbound tourists. Qurayyat has the Ka’af Castle and more agriculture.

KSA also has a number of pilgrimage destinations. Taif is 70km from Mecca, making it an alternative gateway to the Masjid al-Haram.

Flights at the “Big Three” KSA airports feed Cluster2

In 2023 around 43 million passengers flew through King Abdulaziz Airport at Jeddah, according to GACA’s air traffic report. King Khalid Airport in Riyadh had 32 million. At Dammam on the east coast and close to the Bahrain causeway, King Fahd Airport served around 11 million. That makes 86 million passengers.

2,281 of Cluster2’s flights, 77.8% of the total, go to or from the Big Three KSA airports. To see true growth and a realisation of KSA’s aviation dream, these airports will need to see more flights going to international markets.

GACA’s air traffic report also says that 16.2 million passengers went through “other” airports apart from the Big Three and Mecca in 2023. This includes Cluster2’s 22 facilities and three others. If Cluster2 and the other three each receive an even distribution of this traffic, that would mean Cluster2 had around 14.3 million passengers in 2023.

Remember that Cluster2 has 25.7 million seats this year. In 2023 Cluster2 had 397,174 seats in our data week, which can be annualised to around 20.7 million. Cluster2’s seat factor was then 14.3 / 20.7 = 69.1%, well short of my 85% benchmark for seat factor on a commercially typical route. Cluster2’s capacity growth is healthy and the flights do not seem to be going empty exactly. But are enough seats being sold? Time will tell.

Conclusion

Cluster2’s 22 airports provide nearly 25.7 million seats of capacity a year. This may increase to around 40 million by 2030. Nearly 80% of these seats are provided by carriers holding a Saudi Air Operator Certificate and 77.8% of flights go to, from or through one of the Big Three KSA airports.

Most of the rest are provided by Egyptian and UAE airlines. Only the airlines know how many of their seats are sold, but analysing GACA reports and my numbers suggests that Cluster2 airports supplied airlines with a 69.1% seat factor in 2023. This is short of what I consider a healthy 85%.

The schedule is relatively broad with 208 routes from Cluster2’s airports, counting outbound and inbound as two. Sadly in three regions the average route is served less than daily, which is not ideal for consumer and choice and yield.

Many of Cluster2’s airports serve agricultural centres that lack both push and pull factors to stimulate air travel demand. Only a few, such as Yanbu, seem well-positioned for demand growth.

Cluster2’s markets are unlikely to move the needle in terms of reaching KSA’s ambitious 330 million passengers a year target. That will be driven by the Big Three and Riyadh Air.

However Cluster2 will continue to operate the majority of KSA’s commercial runways and serve lots of interesting local markets that are easily overlooked. Will the Saudi air travel dream come true? Riyadh Air’s future performance will depend on it. Cluster2’s performance today will be a good indicator. I will be watching with interest to see how they do.

Read more on Airline Revenue Economics

Saudi Air Mk 2 – my original article about what later became Riyadh Air

Three pitfalls for Qatar Airways to avoid

Air India's new fleet & network options – the “other” airline megaproject