Riyadh Air: Four prescriptions for success

The Saudi startup needs to do more than most airlines to achieve their shareholders' goals

There are two aviation megaprojects in the world today. One is Air India (see article). The other is Riyadh Air in the Kingdom of Saudi Arabia (KSA).

Riyadh Air is mandated by KSA’s Aviation Strategy to help treble passenger volumes to, from, through or within the Kingdom to 330 million by 2030. This would represent around six to eight percent of global demand.

Backed by oodles of cash, the startup airline has made headlines ordering 60 single-aisle Airbus A321neos and 40 twin-aisle Boeing 787-9s.

Flight crew can expect tax-free salaries of USD 384k per year plus benefits (GBP 284k). The cabin programmes were handled by the same designer who supervised the creation of the award-winning Qatar Airways Qsuite (see article).

Yet despite the cash and the attention-grabbing headlines, success is not guaranteed. Setting up airlines is hard.

We can be reasonably sure that the airline will survive as long as there is no regime change in KSA. But will it thrive?

Success criteria for an airline like Riyadh Air are broader than for airlines run commercially, whose goal is simply to be as profitable as possible. Riyadh Air’s shareholders will have five objectives as part of a Kingdom-wide strategy:

1. Generate economic growth in KSA, including the achievement of the Public Investment Fund’s Vision 2030 programme and support of thirteen strategic sectors*

2. Provide air connectivity to, from and within KSA to ensure that as many Saudi citizens as possible have access to easy, affordable air travel

3. Act as a status symbol that represents KSA on the world stage

4. Buy political support at home by giving KSA nationals travel opportunities and a new airline to be proud of

5. Free up incumbent flag carrier Saudia to concentrate on a different set of objectives, which I am not sure about yet, and become more efficient by tidying up their messy network (see article).

* the thirteen strategic sectors are telecoms-media-tech, real estate, finance, utilities & renewables, metals & mining, food & agriculture, leisure & sports, transport & logistics, construction & building services, healthcare, consumer goods & retail, aerospace & defence, and automotive

To meet all these criteria, I offer Riyadh Air a four-part prescription for success that will prevent them becoming just another large, inefficient airline:

1. Use smaller aircraft to boost connectivity

2. Build a Loyalty-first business to stimulate demand & willingness to pay

3. Recruit commercial specialists from other industries to do actual airline retailing, not systems development

4. Offer affordable premium products to monetise the emerging middle class.

Use smaller aircraft to boost connectivity to, from & within KSA

Riyadh Air’s 60 Airbus A321neo single-aisles are too big for many of KSA’s markets.

Cluster2 Airports operates 22 of KSA’s 29 commercial airports. These are small markets. Most are based in agricultural centres. Typical populations for cities served by Cluster2 are in the hundreds of thousands rather than the millions.

Saudi and international carriers are currently serving Cluster2’s small airports with Airbus A320s and Boeing 737s. They currently achieve a seat factor of around 69.1%, according to my calculations (see article), which is rather low.

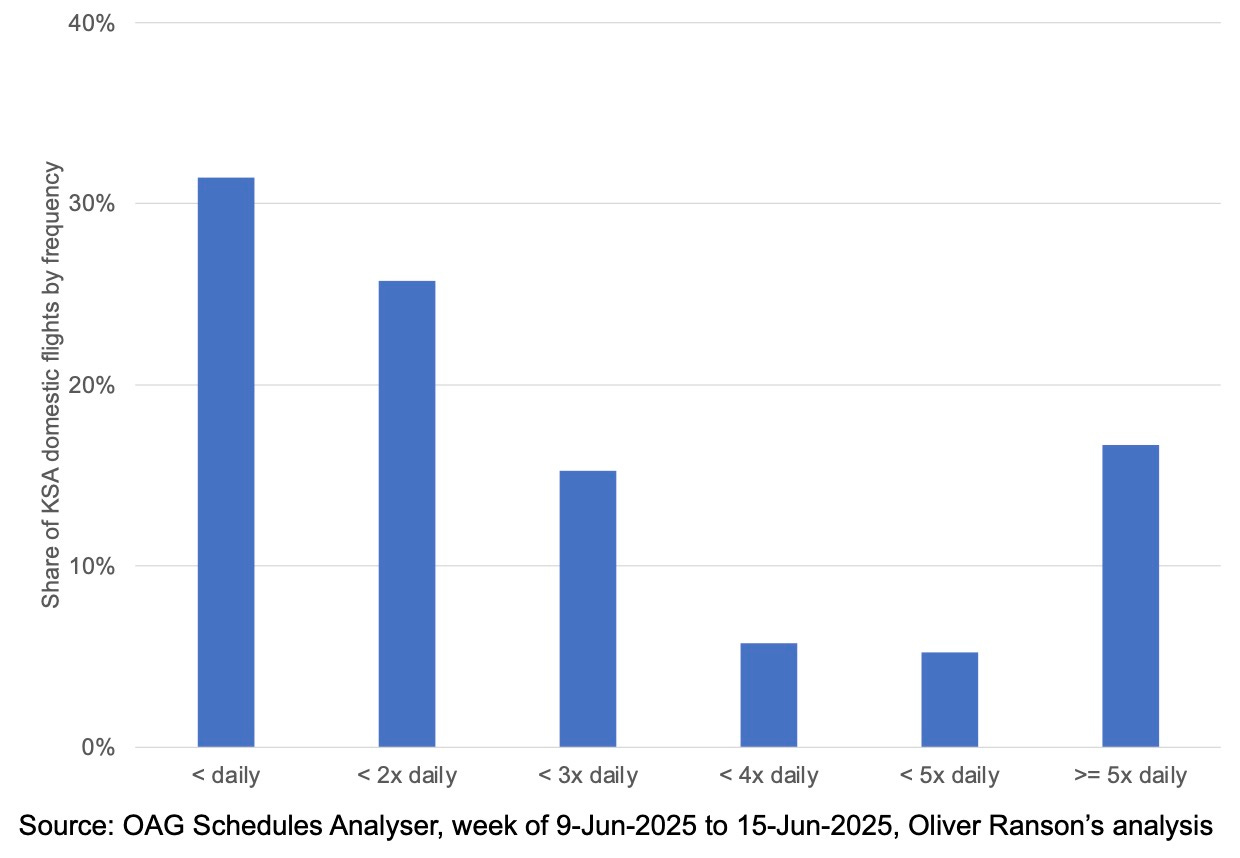

31.4% of KSA’s domestic routes are less than daily too, as shown in the chart below. (A route in this chart is one airline on one city pair, so one city pair served by two airlines is two routes.)

The 60 Airbus A321neos that Riyadh Air has on order are just too big to serve these markets economically. They should invest in smaller aircraft like the Embraer E-Jet or Airbus A220.

A Saudia A321 has 165 seats. Their A320s have up to 144. This is quite low density for an A320. A British Airways A320 with the same number of Business Class seats as Saudia’s (12) would have an extra 30 seats in Economy.

A220s on the other hand typically have around 100 to 130 seats. Since Saudia’s A320s are configured in low density, this places the A220 rather close to the A320 capacity-wise.

Embraer E-Jets are slightly smaller, with between around 70 and 120 depending on the size and the operator’s preference for comfy Business Class seats at the front. Given the low density of the A320s flying around Saudi Arabia, the E-Jet may be more right-sized for the market than the Airbus.

A fleet of E-Jets moving around KSA domestic markets should be able to achieve a seat factor of around 90%.

This would be much more efficient for Riyadh Air than the current A321neos on order. They should be able to use such a fleet to boost frequency and offer at least daily services almost everywhere, helping the shareholders achieve their goal to give air travel access to as many citizens as possible.

A fleet of smaller aircraft would also free up the A321neos to focus on the longer, larger markets they are designed for. This will give consumers more choice, more seats and (in some cases) lower fares.

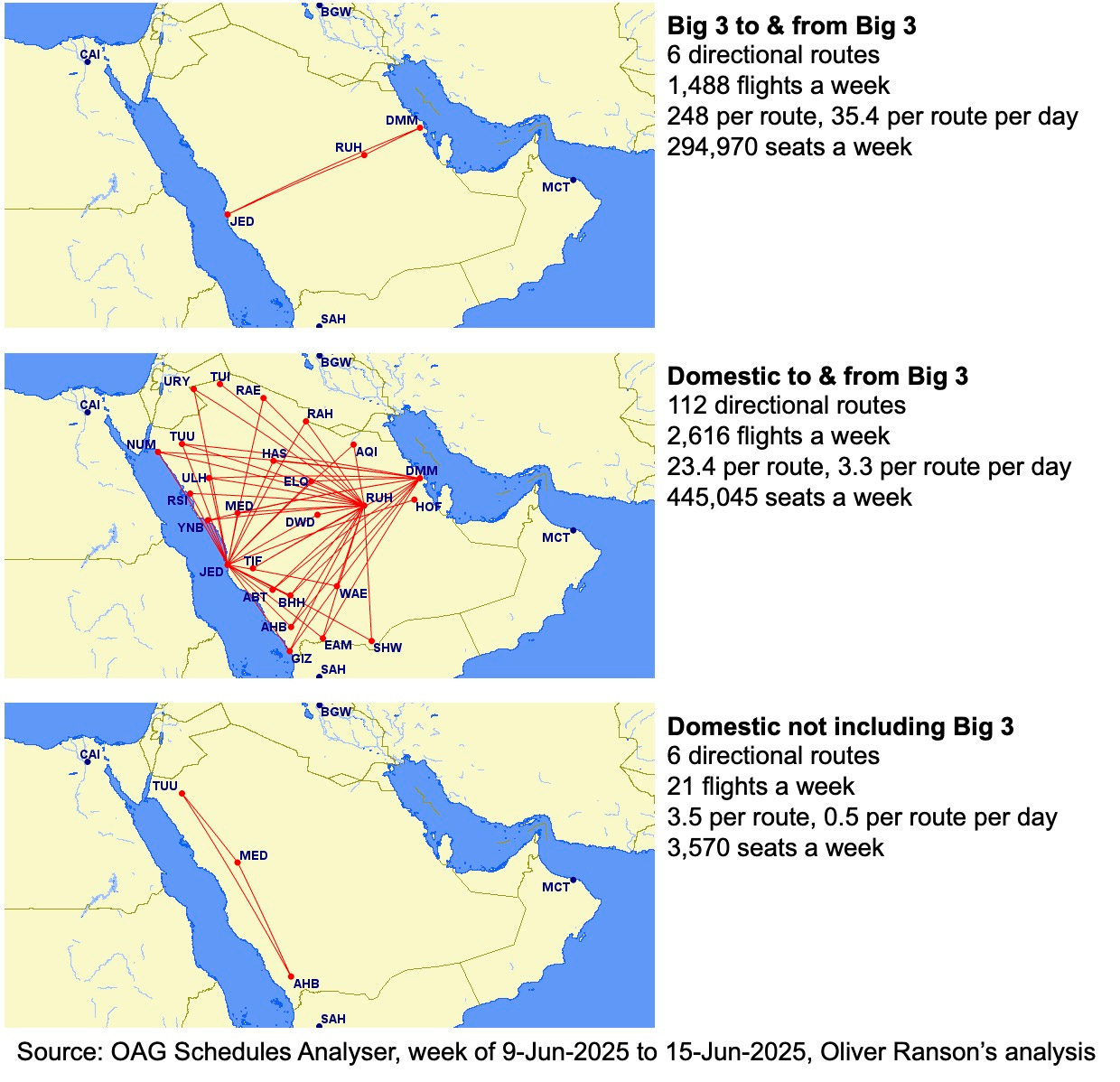

The maps below show the composition of domestic routes in KSA today. Almost all the flights go through one of the “Big Three” airports – Dammam, Jeddah and Riyadh.

[Maps generated by the excellent Great Circle Mapper: visit gcmap.com]

Only 21 out of 4,125 weekly domestic services (0.5%) do not touch one of the Big Three. 1,488 weekly flights (36.1%) are between the Big Three.

Increasing connectivity between the other domestic airports should be a priority for Riyadh Air. Either the A220 or an E-Jet would be a better choice than the A321neos currently on order.

The final decision for aircraft type will of course depend on how the manufacturers price the aircraft.

But I would be inclined to go for the E-Jet, everything else being equal. It has the following advantages:

1. Slightly smaller and lower cost to operate

2. Higher baggage capacity per seat (0.25m^3 on the E-Jet vs 0.23m^3 on the A220) thanks to the “double-bubble” design – baggage will be important for both Saudi travellers and expats

3. Easier maintenance with C-checks at 10,000 flight hours vs 8,500 flight hours on the A220

4. No middle seat in Economy Class and a staggered Business Class configuration option, which could be handy in a market where people may have preferences about their seat-mates.

The seat configuration choice of A220 vs E-Jet is interesting.

The A220 is 2+3. This means that some people have to sit in the middle. But it also means that on every passenger is guaranteed an empty seat next to them whenever seat factor is less than 60%. On the E-Jet though, Economy passengers only get a guaranteed empty adjacent seat at 50% seat factor.

The A220’s extra capacity might be helpful on-peak, but I would argue that if the lower day-to-day operating costs of E-Jet would make up for that and give consumers the chance of going a day earlier or later.

Build a Loyalty-first business to stimulate demand & willingness to pay

Aerospace and transport are just two of KSA’s thirteen strategic sectors. Two others are finance and leisure. By investing in Loyalty, Riyadh Air could become a champion of four strategic sectors and not just two.

Airline Loyalty is more glamorous fintech than ops-focused travel (see article). The schematic below shows how it all works.

A Loyalty company issues miles and points. It sells them to it’s airline partner/owner and also to third-parties. The Loyalty company then buys seats from the airline and potentially other products from it’s partners so programme members can make aspirational redemptions.

The schemes are lucrative. In 2023 Delta Skymiles earned their Atlanta-based parent USD 7 billion (GBP 5.2 billion). In the same year Avios Group Limited, the loyalty arm of IAG, who own a collection of European airlines, turned over GBP 1.284 billion and made a profit before tax of GBP 320.4 million.

While many airlines appear to be killing the goose and turning their programmes, in effect, into discount schemes (see this article, this article and this article), Riyadh Air will be making a fresh start.

A big part of Loyalty is the element of earning an outsized reward. People will spend more money buying flights, especially their employer’s money, if it means they get to take their family on holiday in Premium Economy or Business Class at a bargain price.

Status also matters. When BA tinkered with their status-earning year end there was wailing and gnashing of teeth (see article). When they made status directly linked to spend the frequent flyer community melted down (see article).

Great airlines know that their lounges are revenue generating spaces, not cost centres. They inspire people to buy-up to Business Class, increasing demand and willingness to pay.

They also persuade people to go with a slightly more expensive regional flight with their regular airline. That way passengers get lounge access and there is less pressure on yield.

Riyadh Air should build their business model as “Loyalty First”. They should offer great and compelling Loyalty programmes that inform everything else they do. The first thing they should do is an industry-wide status match (see article) to get existing frequent flyers from all over the world invested in their programme.

Pricing, Revenue Management, Sales, Distribution should all be subject to the objective of maximising customer lifetime value.

Recruit commercial specialists from other industries to do actual airline retailing, not systems development

Airlines have a poor track record of putting the right people in the right positions. Andrew Crawley, currently CEO of Avios Group Limited, used to be CEO of IAG Cargo.

Riyadh Air should think differently. They should recruit their commercial team from retailers and other industries at all levels. First Officers are being offered SAR 60k to SAR 65k (GBP 11.8k to 12.8k) a month. The rate for Captains is SAR 85k to SAR 120k (GBP 16.7k to 23.6k) a month.

If Riyadh Air ends up being stingy (see article) and paying Pricing Analysts SAR 10k a month with Sales Managers on SAR 20k they will not recruit the best people and so not become as successful a business as they could be.

Saving money on revenue generating staff is a false economy. Riyadh Air should avoid that trap.

Revenue Management at an airline like Riyadh Air should be treated like a trading floor in Finance. It should seek it’s personnel from the same pool of talent and pay to attract. There is no reason a truly talented revenue manager should not be earning mid to high six figures (in US Dollars), even without needing to manage people.

Which way will they go? Sadly my money is on them being stingy. Let’s see.

Offer affordable premium products to monetise the emerging middle class

Riyadh Air will not have First Class. Their Business Class and Premium Economy cabins look well designed and attentive to detail but not industry leading like the Qsuite (see article).

This is probably a good thing. Riyadh Air will be targeting Saudi nationals more than any other demographic group. And the Saudi middle class is emerging, not established.

In 2012 30% of KSA’s population was middle class, according to the General Organisation for Social Insurance, a KSA government agency. The GINI coefficient, which measures inequality has been at a stable 46-ish ever since.

So at first glance it looks like the country’s income is as concentrated in the hands of it’s princes as it ever was. I am not convinced that the number of people in the Saudi middle class is growing.

But given the country’s oil wealth and high levels of below middle class population, a significant increase in income for the 30% would not move the overall economic needle so much. I expect the Saudi middle class may not be growing in size, but it may well be growing in income.

If this is the case, Riyadh Air has an opportunity to ensure that a good slice of this market does not just fly the airline, but does so in premium cabins.

Loyalty will be part of it. But so will offering a range of good value fares. Business Class for the chosen many rather than the chosen few should be the order of the day.

Doha may be an expensive place to fly to and from on Qatar Airways (see this article and this article).

Riyadh Air can charge super-high fares on some routes and at some times. But their long term success will depend on persuading prosperous Saudi HENRYs (high-earning, not rich yet) that Premium Economy and Business Class should be part of their lifestyle. This will require good deals at least some of the time.

Conclusion

Riyadh Air is one of two aviation megaprojects today. With 100 top-of-the-range aircraft on order it has oodles of cash. But success is not guaranteed.

The shareholders will have five objectives.

1. Generate economic growth in KSA and support thirteen strategic sectors

2. Provide air connectivity to, from and within KSA

3. Act as a status symbol representing KSA on the world stage

4. Give Saudi nationals travel opportunities and a new airline to be proud of

5. Free incumbent Saudia to concentrate fresh objectives and become more efficient by tidying up their messy network.

A four point plan can help Riyadh Air become actually successful and not just another moderately profitable carrier.

First up, they need some smaller planes. There are only 21 domestic flights a week that are not between at least one of Damman, Jeddah and Riyadh. The 22 smallest airports in KSA have around a 69.1% seat factor.

The A321neos are simply too large for this market. Riyadh Air should buy some E-Jets or A220s to right-size for the market and free up their A321s for the international missions they have been designed for.

Next up is Loyalty. Riyadh Air should be a Loyalty-first business. This will enable them to help support four strategic sectors – finance and leisure as well as transport and logistics.

They should offer great and compelling Loyalty programmes that inform everything else they do. The first thing they should do is an industry-wide status match to get existing frequent flyers from all over the world invested in their programme.

Pricing, Revenue Management, Sales, Distribution should all be subject to the objective of maximising customer lifetime value, rather than being transaction-focused.

Third, it would be a big mistake if Riyadh Air simply recruited all their commercial staff from other airlines. Better to look to retail, technology and finance. Riyadh Air needs actual retailing, not more and more tech.

With Deck Crew on SAR 60k to 120k a month, if we see Pricing Analysts on SAR 10k and Sales managers on SAR 20k we will know that they are not committed to being successful. Revenue Management should be a trading floor with the best revenue traders earning their fortune.

Saving money on revenue generating staff is a false economy. Riyadh Air should avoid that trap.

Finally, Riyadh Air should offer premium cabins at affordable prices, at least some of the time. I am not convinced that the size of KSA’s middle class is really growing as the GINI coefficient, which measures income distribution, looks stable.

But I do reckon that the middle class have more money to spend than they used to. Riyadh Air should have competitive fares to get people used to flying in comfort. That will maximise lifetime value.

Will Riyadh Air actually be successful? They will certainly spend a lot of money, but we will need to wait and see. Look to these four points to see how they are getting on.

Read more on Airline Revenue Economics

Should Oman Air join oneworld?

Airlines are forgetting to look for corner solutions

New Revenue Management Career Paths

[IMAGE CREDIT – cropped]